ESTATE PLANNING IN TEXAS

Wills. Trust. Guardianship planning for kids.

Clear Process. Flat fees. No chaos.

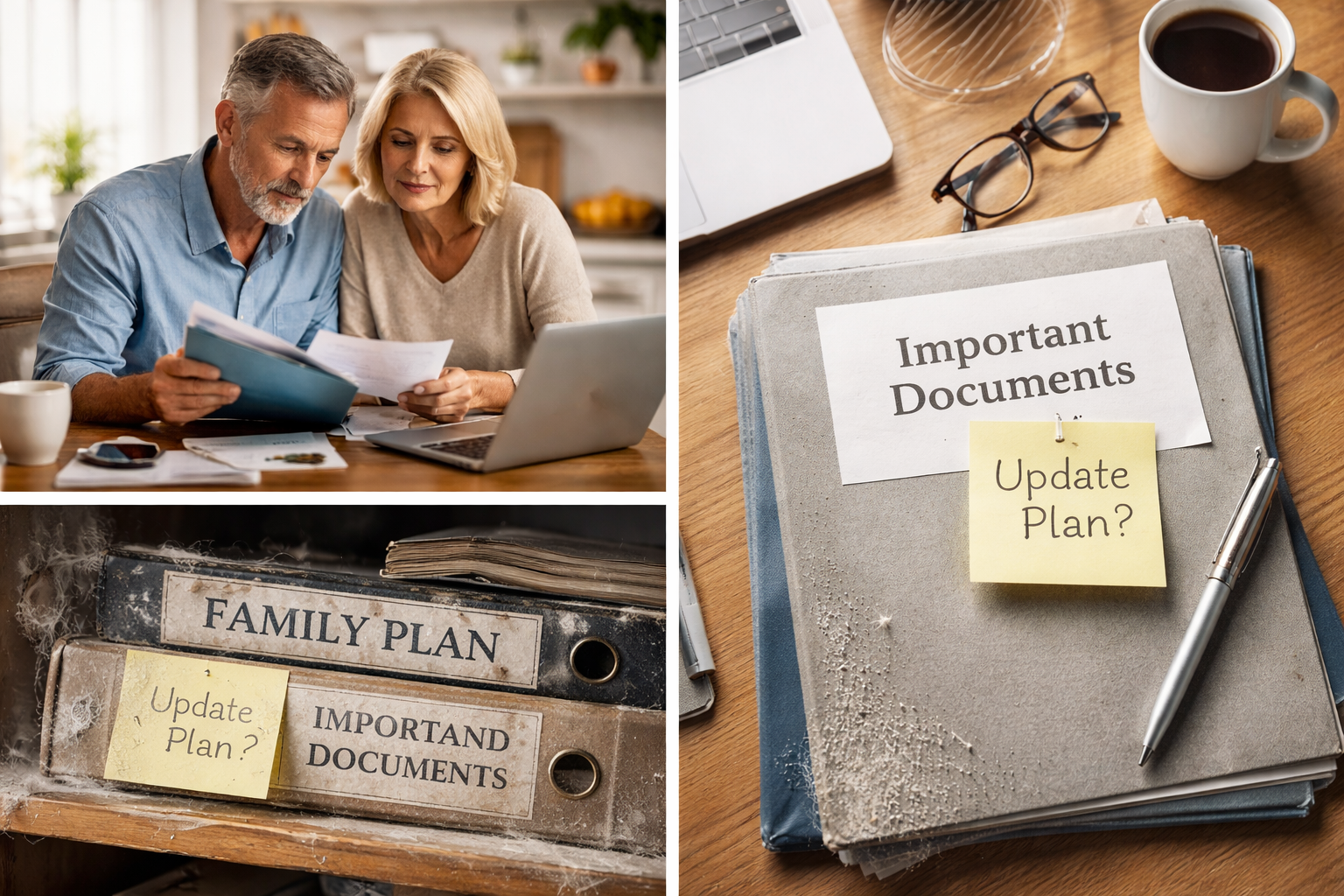

ALREADY HAVE A PLAN

Great. Let’s take a look. We’ll tell you what’s solid, what’s outdated, and what could cause chaos later.

DO YOU REALLY KNOW?

Do you know, with certainty, what would happen legally and financially if something unexpected happened to you?

Not what you hope would happen.

Not what your family assumes would happen.

What would actually happen… under Texas law.

If you don’t have an estate plan, then the State of Texas has one for you. It decides who’s in charge, who gets what, and how long the whole process takes. And it’s rarely what people would choose if they got to read the fine print first.

If you do have a plan, but it’s outdated or incomplete, the result can be the same kind of mess:

Chaos, confusion, COURT!! All of which could have been avoided.

Here’s the bottom line:

If you don’t know exactly what happens to everyone you love and everything you own, step one is finding out. Then you can decide whether the current setup is acceptable… or whether it’s time to take control.

Let’s take the guesswork out of this.

If your “plan” is mostly hope and good intentions, you’re not alone.

Schedule an Intro Call and we will help you get clarity, identify the landmines, and build a Texas plan that holds up in real life.

PLANNING NOW PREVENTS PROBATE PROBLEMS LATER

What This Planning Accomplishes

Keeps your family out of court

Avoid delay, expense, and the public probate process where possible.Puts the right people in charge

So decisions don’t land in the hands of the wrong relative or a judge.Makes sure assets go where you intended

Not “kind of,” not “eventually,” but correctly.

Wills, Trusts & Estate Planning

This is not “fill in the blanks and print.” This is real planning.

We start with a Life & Legacy Planning Session designed to give you clarity. You’ll understand what Texas law would do by default, what would happen to your loved ones and your assets, and where the landmines usually hide (blended families, beneficiary mistakes, outdated documents, and “we’ll just figure it out”).

Before we meet, you’ll complete a Family Wealth Inventory so we have a clear picture of what you own, how it’s titled, and what you actually want to accomplish.

If you decide the current setup isn’t good enough, and we both agree it’s a fit, we build a plan that fits your family and your real-world dynamics.

For many Texas families, the backbone of the plan is a revocable living trust, properly drafted, properly funded and maintained, to help avoid the delay, cost, and public nature of probate.

No matter your situation, we build a Texas plan that holds up in real life.

We serve families throughout North Texas, including Grapevine and surrounding communities.

Texas Estate Planning FAQs

Clear answers to common questions about estate planning under Texas law.

-

Yes. If you pass away without a valid will, Texas law determines who inherits your property and who manages your estate. The result may not match what you would have chosen, especially in blended families or second marriages. A properly drafted will allows you to name guardians for minor children, designate who is in charge, and clearly state how your assets should be distributed.escription text goes here

-

If you do not have an estate plan, the Texas Estates Code controls the outcome. The court decides who administers your estate, and statutory formulas determine who receives your property. For married couples with children from prior relationships, the distribution can be more complicated than many people expect. The process also typically involves court oversight and public proceedings.cription text goes here

-

Not everyone needs a trust, but many families benefit from one. A properly drafted and funded revocable living trust can help avoid probate, maintain privacy, and provide ongoing control over how assets are managed and distributed. Trust planning is often especially useful for blended families, business owners, and those who own real estate in multiple locations.ription text goes here

-

Blended families require careful coordination under Texas community property laws. Without thoughtful planning, assets can unintentionally pass in ways that create conflict between a surviving spouse and children from a prior marriage. A well-structured estate plan can balance protection for a spouse while ensuring that children are ultimately provided for according to your intentions.tem description

-

It depends on how your assets are titled and whether you have a trust in place. Some assets, such as those with beneficiary designations, may pass outside of probate. However, property owned solely in your name often requires a probate proceeding. Planning in advance can significantly reduce or simplify the probate process for your family.

-

Business owners face additional planning considerations beyond a basic will. An estate plan should address who will manage or inherit the business, how ownership interests are transferred, and whether a buy-sell agreement or succession plan is in place. Coordination between your estate plan and your LLC or corporate documents is essential to prevent disruption, disputes, or unintended transfers. Proper planning helps protect both your family and the continuity of your business.

-

Online forms do not evaluate your specific family structure, asset mix, or Texas community property considerations. They also cannot advise you on funding a trust, coordinating beneficiary designations, or avoiding unintended consequences. Estate planning is not simply completing documents; it is ensuring that your plan works as intended under Texas law.

-

The cost depends on the complexity of your situation, including family structure, business ownership, and whether trust planning is appropriate. We use a clear, flat-fee structure so you understand the scope and cost before moving forward. During your initial consultation, we discuss your goals and provide straightforward pricing based on your needs.